Connecting ideas, communities, and innovation to transform education worldwide, driving inclusive, resilient, and future-ready learning for every learner.

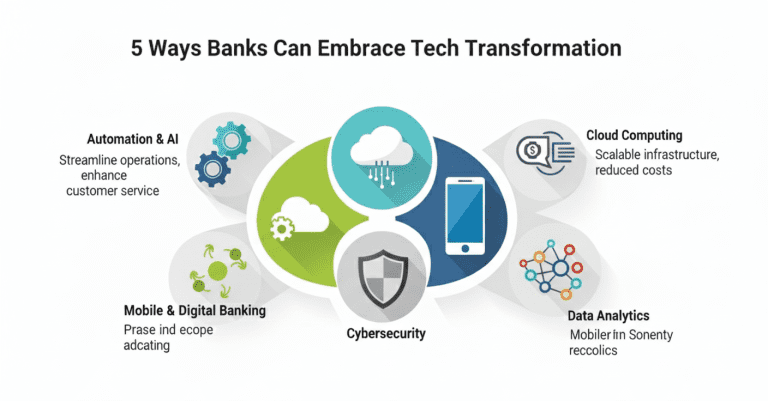

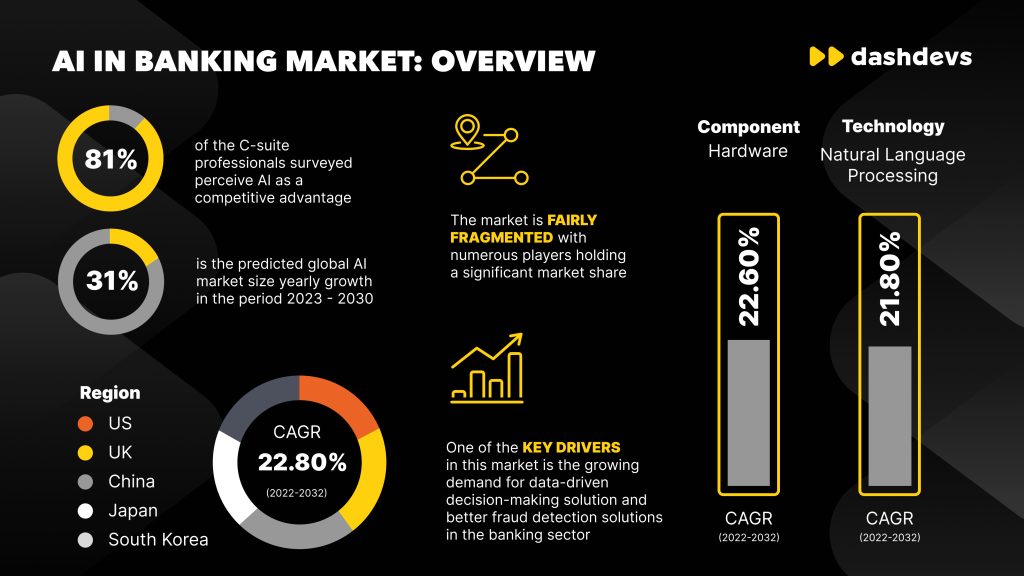

In today’s rapidly evolving financial landscape, technology is no longer an option—it’s a necessity for banks to remain competitive and relevant. Customers expect seamless digital experiences, secure transactions, and personalized services at their fingertips. By embracing innovations such as artificial intelligence, cloud computing, blockchain, and advanced analytics, banks can not only improve efficiency but also strengthen trust, enhance customer engagement, and unlock new revenue streams. This article highlights five key ways banks can successfully embrace tech transformation and position themselves for long-term growth.

Beyond efficiency, tech transformation empowers banks to predict customer needs, deliver tailored financial products, and create new avenues for growth. It also enables stronger risk management, compliance automation, and real-time decision-making, ensuring greater resilience in a dynamic market. For banks, the challenge is not just adopting technology, but integrating it strategically to stay future-ready and customer-focused.

Technology is no longer a support function in banking—it is the foundation of future growth.

-David Marshall

However, digital transformation is not just about adopting new tools—it’s about rethinking business models, streamlining processes, and creating a culture of innovation. Banks that adapt quickly can reduce operational risks, respond faster to market changes, and deliver smarter financial solutions. At the same time, leaders must ensure strong cybersecurity frameworks and compliance to safeguard customer confidence. The ability to blend technology with human-centered strategies will define the future winners in the banking industry.

◎ Digital-first banking is now a necessity, not an option.

◎ AI, blockchain, and cloud computing are redefining efficiency and customer trust.

◎ Customers demand seamless, secure, and personalized financial experiences.

◎ Collaboration with FinTechs is key to driving innovation and agility.

◎ Cybersecurity and compliance remain critical pillars of transformation.

◎ Sustainability and inclusion will shape long-term growth in financial services.

💡 Invest in Core Technologies: Banks should adopt AI, blockchain, and cloud solutions to streamline operations, enhance decision-making, and reduce costs while staying competitive in a digital-first world.

📱 Redesign Customer Experience: Focus on mobile-first, personalized, and frictionless services. Seamless digital experiences help meet rising customer expectations and build loyalty.

🛡️ Strengthen Cybersecurity: Implement advanced security frameworks, threat detection, and compliance measures to protect sensitive data and maintain trust with clients.

🤝 Leverage FinTech Collaboration: Partner with startups and technology providers to accelerate innovation, co-create new solutions, and deliver value-added services efficiently.

🌱 Embed Sustainability & Inclusion: Integrate ESG principles into business strategies and expand access to underbanked communities, aligning growth with long-term social impact.

Sign up to receive notifications about the latest news and events from us!